BLOG AND INSIGHTS

Explore the latest trends and best practices in the industry. As a leader in financing, we've seen firsthand the importance of staying up-to-date with the latest developments and sharing our insights with our community..

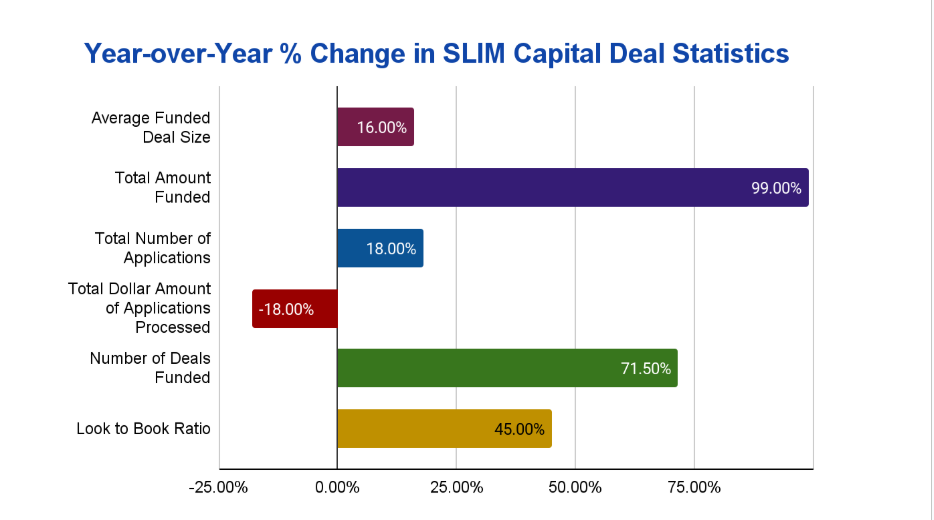

PRESS REALEASE: SLIM Capital Reports Impressive First-Half 2025 Growth

SLIM Capital Reports Impressive First-Half 2025 Milestones with Significant Year-Over-Year Growth

Why Smart Equipment Vendors Offer Financing

Imagine closing more deals, boosting customer loyalty, and creating a steady revenue stream—all while making it easier for your clients to acquire the equipment they need. Sounds like a dream, right? This is the magic of offering financing options.

Why Financing Heavy Equipment is a Smart Move for Your Business

Owning and operating a construction firm means dealing with many challenges, from managing projects to ensuring the safety and efficiency of your team. One of the biggest hurdles is acquiring and maintaining the heavy equipment that is crucial for your operations. Whether it’s bulldozers for earthmoving or cranes for lifting, the right equipment is vital. But heavy equipment comes with a hefty price tag, often putting a strain on your budget.

The Hidden Secrets Behind Fixed and Working Capital for Small Business Success

In the world of business, capital is king. It fuels growth, sustains operations, and ultimately determines the long-term success of any enterprise. For small business owners and entrepreneurs, understanding the intricacies of fixed and working capital can make the difference between thriving and merely surviving. In this blog post, we will explore the essential differences between fixed and working capital, their respective roles in your business, and how to manage them effectively.

How Long Does It Take to Build Business Credit? Tips for Small Business Owners and Entrepreneurs

Building a strong business credit profile is crucial for small businesses and entrepreneurs seeking financial stability. A solid credit history can unlock better interest rates, higher credit limits, and more favorable terms from lenders and suppliers. This financial flexibility supports growth and operational stability. But how long does it take to build business credit? Let's explore this topic in detail.

7 Clear Signs It's Time to Upgrade Your Equipment

In the fast-paced world of business, staying ahead of the curve is critical. For small business owners, entrepreneurs, and tech enthusiasts, ensuring that your equipment is up-to-date is key to maintaining efficiency, productivity, and safety. Your tools and machinery are the backbone of your operations, but they won’t last forever. How do you know when it’s time to invest in new gear? Here are seven telltale signs that it might be time for an upgrade.

DEAL HIGHLIGHTS IN Q3 THAT HAVE US EXCITED FOR A STRONG 4TH QUARTER!

DEAL HIGHLIGHTS IN Q3

THAT HAVE US EXCITED FOR A STRONG 4TH QUARTER!

Need help overcoming challenges in this industry?

SLIM Capital in the news….as featured in NEFA NEWSLINE and spotlight article of Equipment Finance Advisor. Our own Shervin Rashti writes about overcoming challenges in lending to the cannabis industry.

SLIM Capital News & Happenings: Record Breaking Q1 for 2024

SLIM Capital News & Happenings: Record Breaking Q1 for 2024!