Robotics Equipment Financing

The Cost-Effective Approach to Integrating Robotics into Your Business

Looking to build your company’s future with robotics? Financing your equipment could be the key!

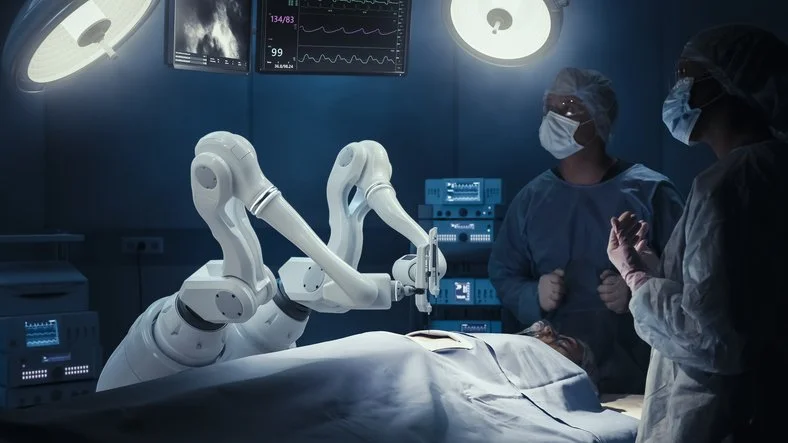

Unlock your company's potential with robotics equipment financing. By leveraging robotics, businesses across industries such as manufacturing, healthcare, and agriculture can perform repetitive tasks with unmatched accuracy and consistency. However, purchasing new robots can be costly. That's where SLIM Capital comes in. Our financing solutions make acquiring top-of-the-line robotic equipment easy and budget-friendly.

With our financing plans, you won't need a large down payment. Instead, enjoy predictable monthly payments tailored to your budget. This allows your business to start benefiting from increased efficiency and revenue generation right away. Additionally, implementing robotics can greatly enhance workplace safety by taking on tasks deemed hazardous for human workers.

Seize the future with robotic systems that streamline operations and boost productivity. With SLIM Capital's financing options, it's easier than ever to integrate this technology into your business model.

Application only up to $300K

680+ FICO Score

Terms Up to 72 Months

5+Years Time in Business

No Suits, Liens, Judgements or BK

No Paynet Scoring Required

Attractive Early Payoff Options

Unlock fast and hassle-free financing for your robotics equipment

We understand how crucial capital is for acquiring the right tools to drive your business forward. That's why we offer competitive rates and predictable payments to make your equipment purchase stress-free.

Applying is a breeze—just a few minutes online, and your application will be reviewed promptly during business hours. Once approved, you'll receive the funding you need quickly, letting you focus on what matters most—your business growth.

Benefit from working with a dedicated account manager who provides friendly and expert service every step of the way. Whether you need assistance or updates, we're just a phone call or email away.

Choosing the right financing partner is important, and with hundreds of five-star customer reviews, SLIM Capital stands out. Feel confident in making us your choice. Apply online now and take the next step in enhancing your operations.

Revitalize your business with cutting-edge robotic equipment!

For a small business like yours, investing in robotic equipment might seem daunting. It can put a strain on your working capital or even deplete it altogether. However, there's a smarter approach!

Choosing to finance your robotic equipment allows you to retain more cash in hand. With predictable monthly payments tailored to your budget, you can start reaping the benefits of your new technology immediately. This option also keeps your reserve funds intact, giving you the flexibility to invest in other innovative areas of your business.

Ready to elevate your business with robotics?

Need answers about equipment financing? We've got you covered!

-

Equipment financing allows businesses to purchase or lease equipment they need to operate efficiently without the upfront cost. This option helps manage cash flow and preserve working capital.

-

From industrial machinery to office furniture, almost any equipment your business needs can be financed. It’s all about supporting your business success!

-

Simply choose the equipment you want, and we’ll provide the financing needed to buy it. You’ll then repay over time through manageable monthly payments. It’s as easy as that!

-

We evaluate your business’s credit profile and the equipment you wish to finance. Our goal is to make the process straightforward and accessible so you can get back to what you do best.

-

Section 179 lets you deduct up to 100% of the cost of equipment you finance for your business. It's a great way to save on taxes and keep more cash available for other expenses. By using Section 179 with equipment financing, you can significantly boost your bottom line. Check out our guide for more on Section 179 and other small business tax deductions.